For decades, California has been a national leader in fighting climate change, utilizing many different initiatives and programs to reduce greenhouse gas (GHG) emissions in the state. To pursue this effort, the California Air Resources Board (CARB) regularly updates its Scoping Plan to lay out the state’s strategy for achieving its goals. Among other things, the Scoping Plan includes specific policies targeted at increasing the adoption of zero‑emission vehicles (ZEVs), increasing the use of lower‑carbon fuels, and reducing the number of vehicle miles traveled (VMT).

While these efforts should assist in accomplishing CARB’s mission of GHG reduction, it will come at a cost. In a recent report titled “Assessing California’s Climate Policies – Implications for State Transportation Funding and Programs,” the Legislative Analyst’s Office (LAO) estimates how much meeting the state’s GHG reduction goals could impact existing state transportation revenues and programs. The news is not good.

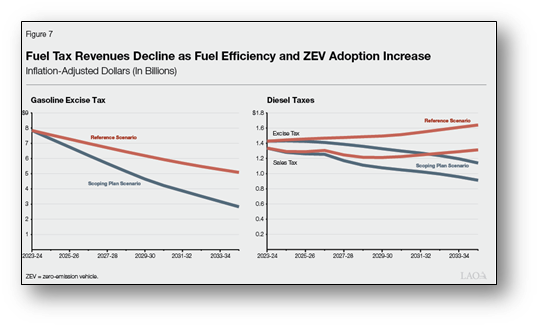

Specifically, the LAO concludes that CARB’s policy directives for GHG emission reduction will have dramatic negative impacts on the state’s transportation revenues. This is because the vast majority of transportation funding in California is derived from taxes on motor fuels such as gasoline and diesel. If people are driving more fuel-efficient vehicles (or zero-emission vehicles), and are driving fewer miles in total, then the state is collecting less fuel tax revenues.

Compared to current transportation funding levels, the LAO projects dramatic revenue declines over the next decade from the state’s gasoline excise tax ($5 billion or 64 percent), diesel excise tax ($290 million or 20 percent), and diesel sales tax ($420 million or 20 percent). On net, the LAO estimates that if the state follows CARB’s Scoping Plan to reduce GHGs, annual state transportation revenues will decline by $4.4 billion (31 percent) over the next decade as compared to current levels.

Source: Legislative Analyst’s Office Report

The projected revenue declines will result in certain state transportation programs having less capacity to support state and local transportation projects and activities. For instance, the LAO projects funding for Caltrans’ highway maintenance programs will drop by roughly $1.5 billion (26 percent) over the next decade, from $5.7 billion to $4.2 billion. In addition, the LAO estimates that the State Transit Assistance program, which funds local transit operations, will experience funding declines of about $300 million by 2034‑35, or about one‑third of its total funding.

In cases where programs distribute funding to local governments, such as for local streets and roads and transit, the magnitude of the impacts will vary across jurisdictions. In general, jurisdictions that historically have been more dependent on state funding for their local efforts will experience greater impacts across their transportation systems, likely resulting in reduced services and/or poorer road conditions for their residents.

In order to maintain our local streets and roads and transit funding, one of two things must happen: either the state needs to reverse its efforts to reduce GHG emissions from the transportation sector (which is highly unlikely), or the state will need to find an alternative funding source for its transportation needs. While the state has several approaches it could pursue to replace the dwindling tax revenues, each comes with various benefits and trade‑offs that will need to be considered.

Options for addressing the funding gaps include:

- Increasing existing fuel taxes to try and maintain funding levels

- Increasing other existing vehicle fees to replace the dwindling fuel tax revenues

- Supplementing with other funding sources like the General Fund or Cap-and-Trade revenues

- Implementing a new mechanism for collecting transportation revenue e.g. a road charge

- Implementing new taxes on alternative fuels and dedicating the revenues to transportation

Beginning to weigh these options now is critical before revenue declines become more significant. However, it appears that this issue is not on the Legislature’s radar. There have been no legislation introduced this year to address this concern, and the Governor’s budget does not acknowledge the impending revenue declines. Therefore, it is upon our local municipal leaders to begin presenting our concerns about future local transportation funding to our representatives. Using the LAO’s report to present the issue can make this effort more manageable. If we don’t begin the conversation soon, the problem will only grow and the solutions will be more difficult to enact.